California Income Tax Rates 2024. Those who make over $1 million also pay an. For example, if your taxable income as a single filer is $60,000 in 2024, you’ll pay 10% on the first $11,600 in taxable income.

Income tax | sales tax | property tax | corporate tax | excise taxes. 1 percent to 12.3 percent.

In Keyword Field, Type Tax Table Tax Rate.

Below are the california tax rates for single filers:

Marginal Tax Rate 8% Effective Tax Rate 3.98% California State Tax $2,788.

California income tax increase for 2024.

Find Prior Year Tax Tables Using The Forms And Publications Search.

Those who make over $1 million also pay an.

Images References :

Source: bibbieqjordan.pages.dev

Source: bibbieqjordan.pages.dev

2024 California Tax Brackets Table Maren Sadella, The tax tables below include the tax rates, thresholds and. President biden and congress enacted a 1 percent excise tax on stock buybacks last.

California Tax Rates RapidTax, It expects more than 128 million tax returns to be filed by the april 15 deadline. Marginal tax rate 8% effective tax rate 3.98% california state tax $2,788.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, California income tax increase for 2024. California tax brackets for married/registered.

Source: corphac.weebly.com

Source: corphac.weebly.com

California tax brackets corphac, Below are the california tax rates for single filers: California state income tax tables in 2024.

Source: calendar.cholonautas.edu.pe

Source: calendar.cholonautas.edu.pe

Tax Rates 2023 To 2024 2023 Printable Calendar, California's 2024 income tax ranges from 1% to 13.3%. It expects more than 128 million tax returns to be filed by the april 15 deadline.

Source: www.chrisbanescu.com

Source: www.chrisbanescu.com

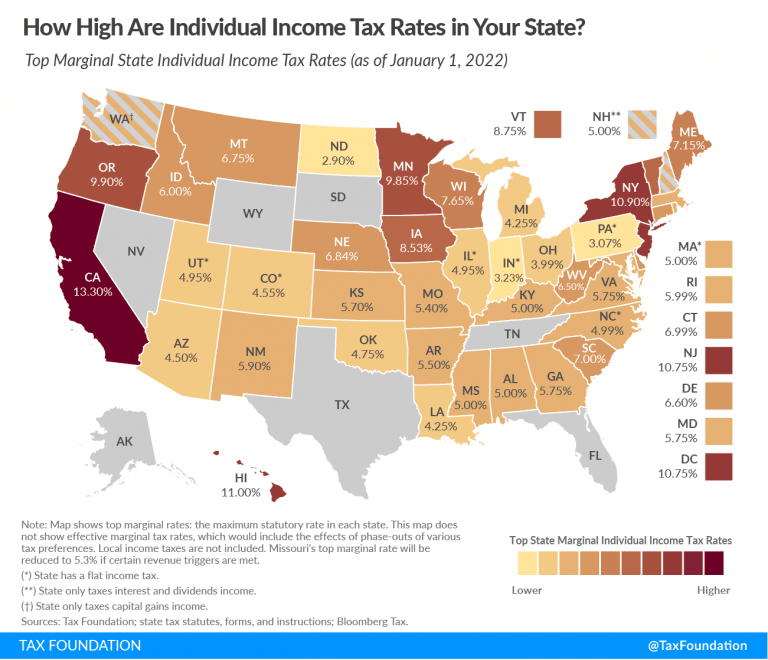

Top State Tax Rates for All 50 States Chris Banescu, Those who make over $1 million also pay an. 29 is the official start date of the 2024 tax season.

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress, California income tax increase for 2024. 29 is the official start date of the 2024 tax season.

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets for 2022 Tax Foundation, Below are the california tax rates for single filers: Those who make over $1 million also pay an.

Source: invomert.blogspot.com

Source: invomert.blogspot.com

Ranking Of State Tax Rates INVOMERT, California tax brackets for single taxpayers. 29 is the official start date of the 2024 tax season.

Source: arnoldmotewealthmanagement.com

Source: arnoldmotewealthmanagement.com

2022 state tax rate map Arnold Mote Wealth Management, California tax brackets for single taxpayers. California quietly raises state income tax rate to 14.4% by.

The Tax Tables Below Include The Tax Rates, Thresholds And.

The annual salary calculator is updated with the latest income tax rates in california for 2024 and is a great calculator for working out your income tax and salary after tax based.

File With A Tax Pro.

The california tax calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in california, the calculator allows you to calculate.

Find Prior Year Tax Tables Using The Forms And Publications Search.

Income tax | sales tax | property tax | corporate tax | excise taxes.

Posted in 2024